📢 Free Amazon growth audit →

Business License

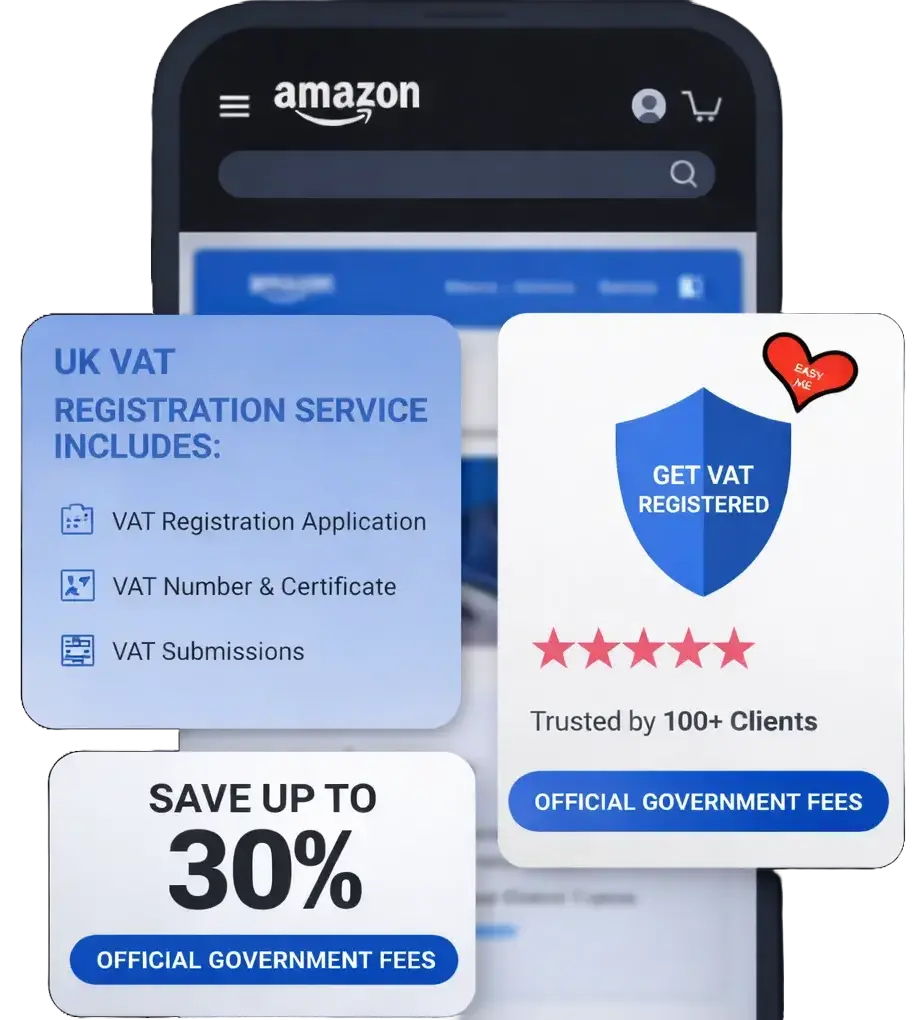

Get VAT Registered the Right Way Without the Stress

- Understand if VAT registration is required

- Complete VAT registration correctly

- Manage VAT rules with confidence

- Stay compliant and avoid costly VAT mistakes.

VAT registration service includes:

VAT eligibility assessment

VAT registration application

VAT number and confirmation support

VAT compliance guidance

Ongoing VAT support

Proof that the right strategy works

Proof that the right strategy works

213% increase in 1 month

- Orders increased three times

- Page views doubled

- Total sales grew by 118 percent

Owner

FAQs

What is VAT?

VAT (Value Added Tax) is a consumption tax charged on most goods and services in the UK. Registered businesses must charge VAT and submit VAT returns to HMRC.

When do I need to register for VAT?

You must register if your taxable turnover exceeds £85,000 in a 12-month period. You can also register voluntarily below this threshold.

Can non-UK businesses register for UK VAT?

Yes. Non-UK and non-resident businesses can register for UK VAT if they supply taxable goods or services in the UK.

How long does VAT registration take?

VAT registration usually takes 2–6 weeks, though it may take longer if HMRC requests additional information.

What documents are required for VAT registration?

Commonly required documents include:

* Company incorporation details * Director/shareholder identification * Business activity description * Proof of trading or intent to trade.

What VAT rate will I charge?

The standard UK VAT rate is 20%, though some goods and services qualify for reduced (5%) or zero-rated (0%) VAT.

How often do I need to file VAT returns?

Most VAT-registered businesses file quarterly VAT returns using Making Tax Digital (MTD) compliant software.

What happens if I don’t register for VAT on time?

Late registration can result in penalties, interest, and backdated VAT payments, so timely registration is essential.

Don’t see your answer here? Schedule a call with us!