📢 Free Amazon growth audit →

Business License

Launch Your US Business With a Proper Legal Foundation

- Register your LLC without confusion or delays.

- Set up your business for banking and taxes.

- Stay compliant with state requirements.

- Launch your US company with clarity and confidence.

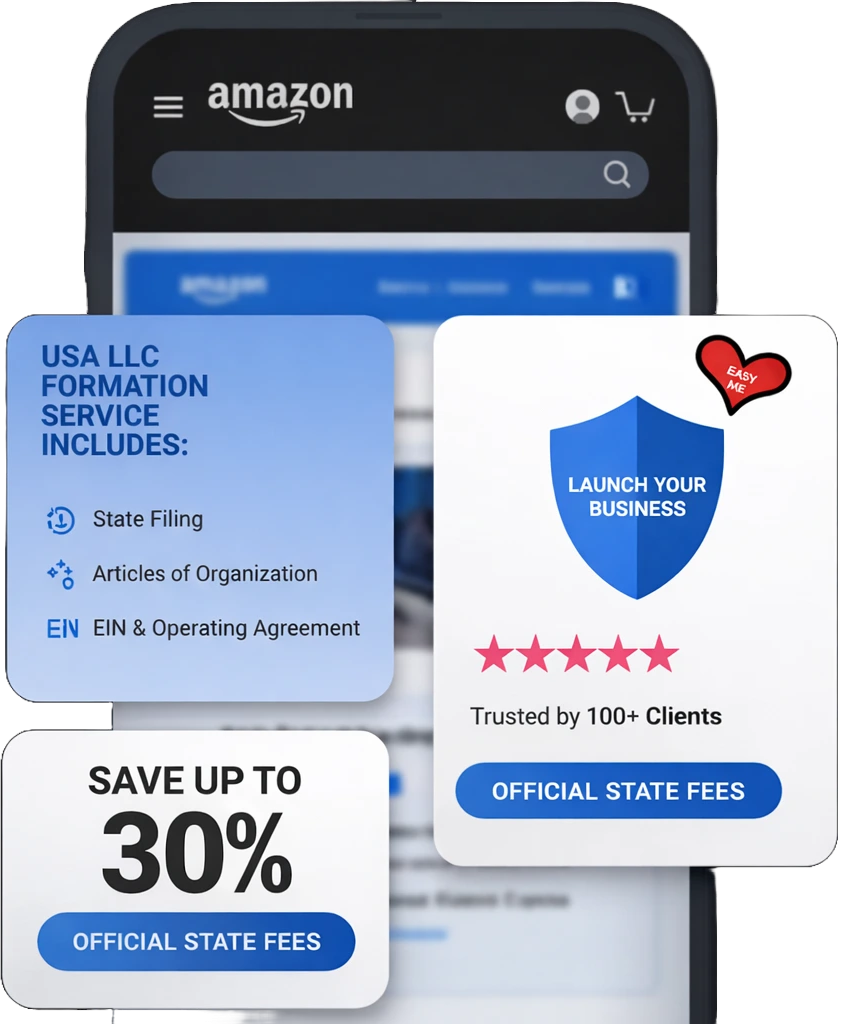

USA LLC formation service includes:

State selection and LLC registration

Articles of Organization filing

EIN application support

Operating Agreement setup

Compliance and renewal assistance

Proof that the right strategy works

Proof that the right strategy works

213% increase in 1 month

- Orders increased three times

- Page views doubled

- Total sales grew by 118 percent

Owner

FAQs

What is an LLC?

An LLC (Limited Liability Company) is a business structure that protects your personal assets from business debts and liabilities while offering flexible tax options and simple management.

Do I need an LLC to start my business?

Not always, but forming an LLC is highly recommended if you want liability protection, increased credibility, and clearer separation between personal and business finances.

What information is required to form an LLC?

Typically, you’ll need:

* Business name * Business address * Owner(s) information * Registered agent details * State of formation

How long does it take to form an LLC?

Most LLCs are approved within 20-30 business days, depending on the state and whether expedited filing is selected.

What is a registered agent and do I need one?

A registered agent is a person or company that receives legal and government documents on behalf of your LLC. Most states require one, and using a professional agent helps maintain privacy and compliance.

How much does it cost to form an LLC?

State filing fees usually range from $200 to $1000, depending on the state. Additional services (registered agent, operating agreement, EIN filing) may affect total cost.

How is an LLC taxed?

By default, LLCs are taxed as pass-through entities, meaning profits are reported on the owner’s personal tax return. However, LLCs can choose to be taxed as an S-Corp or C-Corp if beneficial.

What ongoing requirements does an LLC have?

Most LLCs must file annual or biennial reports, maintain a registered agent, and stay current with state fees and licenses.

Don’t see your answer here? Schedule a call with us!